View our rebranding of AJ Capital Partners Doejo

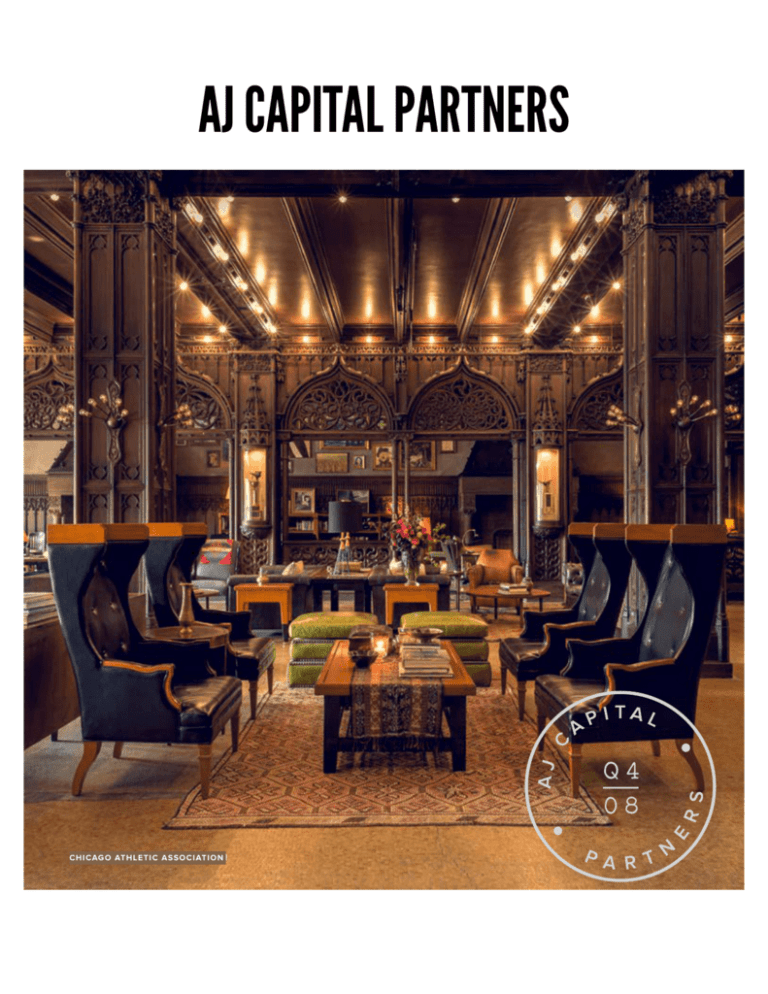

AJ Capital Partners is a vertically-integrated real estate investment manager anchored by the core principles of hospitality, placemaking, and residentially inspired design.

Graduate Hotels AJ Capital Partners Hotel, Graduate oxford, Design

Founded Date 2008. Founders Benjamin Weprin. Operating Status Active. Investor Type Private Equity Firm. Investment Stage Private Equity. Contact Email [email protected]. Phone Number 312 267 4185. AJ Capital Partners is a dynamic organization of counter-culture hospitality and real estate investors.

AJ Capital Partners (enUS)

The Louisiana Children's Museum located at 420 Julia St. in New Orleans, La. Tuesday, June 18, 2019. As developers put the finishing touches on a new hotel and residential complex in the former.

View our rebranding of AJ Capital Partners Doejo

AJ Capital Partners General Information Company Description. Founded in 2008, AJ Capital Partners is a real estate firm based in Nashville, Tennessee. The firm seeks to invest in hospitality, multi-family, office, and retail sectors based in the United States, the Caribbean, and Mexico.

Learn More AJ Capital Partners

AJ Capital Partners is seeking a strategic partner to supply growth capital and pay down property level debt for Graduate Hotels, a lodging brand focused on serving college campuses. AJ Capital is.

AJ Capital Partners

AJ Capital Partners, based in Chicago, is an accomplished team of hospitality and real estate investors whose innate passion is to create a one-of-a kind portfolio of timeless assets. The counter.

AJ Capital Partners (enUS)

Developer AJ Capital Partners moves HQ from Chicago to Nashville, with $650M investment in play. expand. Ben Weprin, founder and CEO of AJ Capital Partners, photographed at one of his Graduate.

Portfolio AJ Capital Partners

AJ Capital Partners is a real estate investment manager committed to building timeless, scalable businesses and branded platforms. Our vertically integrated team delivers returns on transformative real estate by applying placemaking, inspired design, and hospitality principles to spaces overlooked by traditional investment firms.

AJ Capital Partners acquires Atherton Hotel Hotel Management

AJ Capital Partners founder and CEO Benjamin Weprin and properties at 7133 Northwest Second Court and 7122 Northwest Second Avenue (NorthWestern.edu, Google Maps) Feb 24, 2022, 2:30 PM. By .

AJ Capital Partners Acquires The Inn At USC In Columbia, South Carolina

1835 Village Center Circle Las Vegas, NV 89134 702-405-8500 (MAIN) / 702-405-8501 (FAX) www.nvbusinesslaw.com March 16, 2020 Launching A Nevada Trust Company Matthew D. Saltzman, Esq.

AJ Capital Partners pays 87 million for Belle Meade Plaza

AJ Capital Partners is teaming up with a global retail developer to bring around 300,000 square feet of high-end shopping to the Nashville market's "southern high-income area."

AJ Capital Partners (enUS)

"Memoir is AJ Capital's first branded multifamily residential platform. We are taking the same approach we use for hotels, mixed-used communities, and entertainment venues - leading with.

AJ Capital Partners Breaks Ground on Graduate Nashville Set to Open

AJ Capital Partners | 11,814 followers on LinkedIn. AJCP is a vertically integrated real estate investment manager anchored by the core principles of hospitality, placemaking, and residentially.

AJ Capital Launches Memoir Residential Multifamily Executive Magazine

Church bought the building for $24.5 million from Rich along with Ben Weprin, founder of boutique real estate investment management firm AJ Capital Partners, which also owns the famous Exit/In.

AJ Capital Partners Harnesses BTR Boom with Outpost Residential

About AJ Capital Partners. Adventurous Journeys ("AJ") Capital Partners is a vertically integrated real estate investment manager founded in 2008. The firm repositions real estate to build timeless, scalable businesses and brand platforms. We deliver returns on transformative real estate by applying placemaking, inspired design, and hospitality.

Chicago's Coolest Offices 2016 Crain's Chicago Business

AJ Nashville Phase II Opportunity Fund LLC raised $109.4 million from 130 investors, close to its target of about $113.3 million. The private equity fund is managed by real estate investment manager AJ Capital Partners, officially known as Adventurous Journeys Capital Partners LP. Founded by Benjamin Weprin, the firm has more than $1.7 billion.